Life Insurance in and around Indianapolis

Protection for those you care about

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

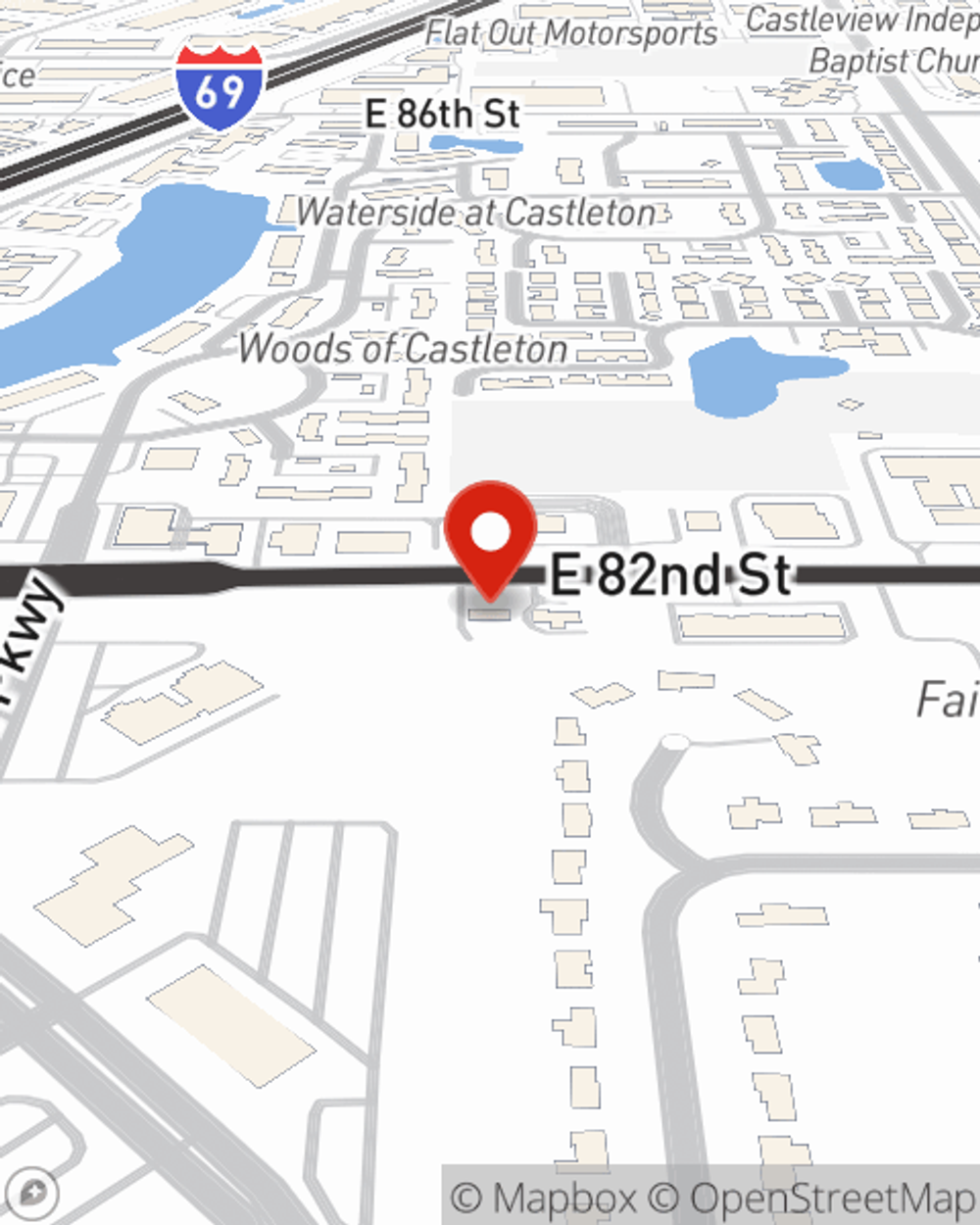

- Downtown Indy

- Fishers

- Castleton

- Carmel

- Zionsville

- Westfield

- Noblesville

It's Never Too Soon For Life Insurance

Do you know what funerals cost these days? Most people aren't aware that the common cost of a funeral today is $8,500. That’s a heavy burden to carry when they are facing grief and pain. If your loved ones cannot come up with that much money, they may be unable to make ends meet following your passing. With a life insurance policy from State Farm, your family can thrive, even without your income. Whether it keeps paying for your home, pays for college or pays off debts, the life insurance you choose can be there when it’s needed most by your loved ones.

Protection for those you care about

Now is a good time to think about Life insurance

State Farm Can Help You Rest Easy

Fortunately, State Farm offers several coverage options that can be adjusted to accommodate the needs of those most important to you and their unique situation. Agent Brandon Libunao has the personal attention and service you're looking for to help you choose a policy which can support your loved ones in the wake of loss.

State Farm offers a great option for someone who thought they couldn't qualify for life insurance: Guaranteed Issue Final Expense. This coverage can be helpful by covering final expenses like medical bills or funeral costs, ensuring that your loved ones won't have to bear the burden. For more information, contact Brandon Libunao, your local State Farm agent and see how you can be there for your loved ones—no matter what.

Have More Questions About Life Insurance?

Call Brandon at (317) 849-4119 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Brandon Libunao

State Farm® Insurance AgentSimple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.